Learn all about WYND DAO, the new WYND DEX, and their planned Vampire Attack on competitor JunoSwap.

What is WYND DAO?

WYND is a multi-protocol DAO deployed on the Juno network that heavily utilizes CosmWasm smart contracts. It is lead by the WYND Foundation Advisory DAO including Ethan Frey, the father of CosmWasm, and was launched in September 2022.

The vision of this interchain DAO is to manage various DeFi protocols on multiple blockchains in the Cosmos ecosystem.

WYND DAO pursues Regenerative Finance (ReFi). ReFi aims to use the power of blockchain technology to positively impact the environment.

25% of the revenue from fees raised by interacting with WYND protocols will go to an Environmental DAO. This Environmental DAO will invest in projects such as planting trees and cleaning up ocean plastics.

Stakers of WYND's native token ($WYND) earn rewards and can participate in governance to guide the protocol. Previously airdropped tokens are currently vesting until September 2023, but you can still stake them for predefined staking periods.

Side Note: In November 2021 at Hackatom VI, WYND DAO won the Grant.fish & Juno Challenge. You can watch Ethan's explanatory video and find out more about the Hackatom win at the Devpost link below.

Wynd DEX

WYND are currently developing a decentralized exchange for Cosmos which is due to be completed soon.

Pavlov's Bell, from the WYND DAO Business Development and Marketing Team, outlines the benefits of their "revolutionary dex-like product" as follows:

Liquidity Providers

- Organic sustainable yields which will not be dependent on artificial incentives, both internal and external

- Mitigated effects of impermanent loss compared to traditional liquidity pools

- Earn credits from liquidity providing which offsets trading fees

Traders

- Lower trading fees offset by credits earned by liquidity providing

- Lower or equal slippage to some of the largest DEXs in the ecosystem via cross-chain liquidity aggregation

- The long tail of CW20 assets

JunoSwap vs. WYND DEX

JunoSwap was the first interchain DEX focused on CW-20 (CosmWasm) asset adoption. It's native token is $RAW and it is governed by RAW DAO.

This month, WYND DAO have outlined a liquidity migration plan for JunoSwap bonded LP positions to more easily join the new WYND DEX.

The WYND DAO marketing team further explain this:

"WYND DAO is creating a smart contract to seamlessly migrate bonded liquidity from Junoswap to WYND DEX. By participating in this plan, users can migrate their LP positions to WYND DEX without needing to unbond from Junoswap LPs."

Once the WYND decentralized exchange is live, users of JunoSwap can migrate their Liquidity Pool positions for a period of up to 60 days.

Liquidity mining incentives to bootstrap liquidity and reward users will also be available to early adopters.

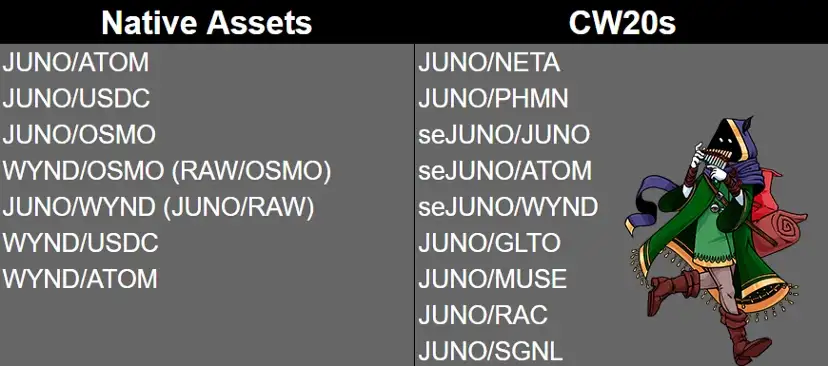

The following liquidity pools below will be on WYND DEX at launch, which is expected for the end of December 2022:

Keep an eye on the official WYND DAO socials and Cosmos News Twitter for future updates on the WYND DEX launch.

JunoSwap Vampire Attack

This occurs in DeFi where one protocol incentivizes users of another protocol to migrate, thus stealing their customers and investors.

By offering to migrate liquidity, this sends the message that JunoSwap is now outdated and signals for the rise of WYND Dex as it will lure away many of JunoSwap's existing customers. We have reached out to Ben from the JunoSwap team for comment, but have heard nothing back as of yet.

We reached out to Ethan Frey asking what percentage of WYND tokens are allocated for burned RAW tokens. This is what he had to say:

"When we burn RAW we replace them with equal value of WYND, valuing WYND at $1. There are around $860k RAW in LP pools and $420k RAW staked."

We also asked him if there was a private sale and what allocation was given to this group of investors. He informed us that of the foundations allocation (20%), a small amount was sold to private investors:

"It is not public. But there was a relatively small amount of angel funding and it is also subjected to a 1 year linear vesting schedule."

The current token distribution as it stands is:

- 20% WYND Foundation

- 15% Development Team

- 65% Airdrop

The Newsletter

Sign up to learn the latest about the Cosmos ecosystem.

RAW Pair Incentives

In particular, the migration of Liquidity Pools with a RAW pair will result in the burning of RAW tokens while WYND will be airdropped to the corresponding pool on WYND DEX.

For example: If a user migrates their JUNO/RAW LP position from Junoswap to WYND DEX, the exact same amount of JUNO will be migrated over. However, the RAW will be burned and WYND will be airdropped into the corresponding JUNO/WYND pool on WYND DEX.

For comparison, LP's without a RAW pair will be 1:1 transferable from JunoSwap.

Juno Proposal #61

This view is also reflected in a recent proposal which was voted on by the Juno community.

Way back in Proposal #14 on the Juno network (in Febraury 2022), the JunoSwap core development team received close to 3,000,000 $JUNO in order to kickstart liquidity incentives on JunoSwap.

This month, Proposal #61 was raised, requesting to sunset the approx. 1,000,000 $JUNO remaining in the Liquidity Incentives Fund for JunoSwap.

All incentives for pools JUNO/ATOM, JUNO/RAW, and JUNO/USDC will now be interrupted, pending future community instruction and "awaiting other Dex protocols to deploy".

Conclusion

Will WYND Dex be the next innovative exchange in the Cosmos ecosystem to surpass its competition? At this stage it looks at the very least to have a bright future in the space. The expected release date for WYND DEX is end of year, possibly early January. Exciting times ahead, so stay tuned!

Thank you for reading, fellow Cosmonauts! If you've been enjoying our work, please consider following our Twitter, or you can help us by sharing.

Disclaimer: none of the information given in this article is financial or investment advice. Please do your own research and assess your own risk.